How to Invest - Philosophy

Using Stamps as an Investment

"Investing in rare stamps requires a high degree of expertise and can be very risky for the novice. Rare stamps are among the most portable of tangible investments, take up little space but require careful storage as condition is one of the most important factors in determining the value of a stamp. Other tangible investments include art, antiques, precious metals, rare coins and many others that are all termed alternative investments. Interest in stamps as an investment tends to increase when traditional investments are not doing well, causing investors to seek alternatives. The increasing age of the population in western countries has also been credited with a resurgence in interest in stamps." - Wikipedia

Warren Buffett once said that the gum on the back of a postage stamp is the most valuable substance on earth.

The intrinsic value of rare stamps is multi-faceted:

- Deep human connections are formed between the collector/investor and their collections or portfolios that reflect their most profound personal aspirations.

- Stamps hold powerful emotional meaning for both collectors and investors that connect them with a deep sense of timeless memorable experiences.

- All stamps, from the most common topical to the most valuable rarity, form links between their cultural and historical significance and ourselves, where we came from, who we are, and whom we aspire to be.

Three principle indicators form essential tangible stamp investments:

- Deep lifetime collectors maintain longtail investitures - often decades at a time - driven by passion and pride of ownership.

- The very nature of such discretionary investments exhibits strong resistance to general economic trends.

- The inescapable demand of a growing population of global investors in a profoundly limited supply, insures the certainty of supply vs. demand longevity.

Investment in stamps is over 150 years old. While the acquisition of valuable asset class stamps remains the principle domain of a definitive collecting community with a shared knowledge base, serious peripheral investment has emerged as a major player in the establishment of intelligent diversified portfolios.

Stamp Market Index will provide immeasurable assistance to both core and peripheral investors to identify distinctive trends in all classes by demonstrating historical price performance. Like any discretionary market, there will always be periodic fluctuations due to profit taking and supply/demand constraints.

Use Stamp Market Index prices realized as a comparison engine to identify:

- Undervalued opportunities

- Well populated areas of popular interest

- Slow moving depressions of overvalued or bloated commons

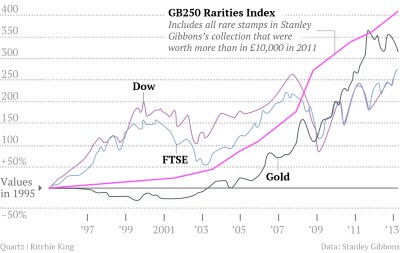

The trend in escalating values, as well as world record prices to date, is a clear positive key indicator of a persistent upward trajectory

The accompanying graph illustrates the sharp consistent spike associated with the introduction of peripheral investors from the early 1970s to 1990s with access to historical analysis.

Serious investors started building tangible asset class portfolios in stamps when they noticed popular interest keeping pace with prices realized.

SOURCE: Daily Telegraph

https://www.telegraph.co.uk/business/2016/07/11/rare-stamps-a-better-investment-than-shares-property-and-gold

SOURCE: BBC

http://www.bbc.com/news/business-36024614

SOURCE: MarketWatch

https://www.marketwatch.com/story/you-should-have-invested-in-bill-gross-stamps-collection-2019-02-05